Quarterly Newsletter - Winter 2022

Director's Message

Hello all and Happy 2022!

As I write this, it is difficult for me to believe that it is truly 2022. It seems as though it was just yesterday that I was wishing you all a happy 2021.

I think we can all agree that what we have experienced over the last two years have brought about some big changes! While change can often be viewed with a sense of unease, I try to view it as something that brings opportunity for new possibilities, experiences, and growth.

One thing that has not changed is the dedication that the staff of the Oregon Special Needs Trust has to making sure that each individual beneficiaries’ needs are addressed and that you feel heard and cared for.

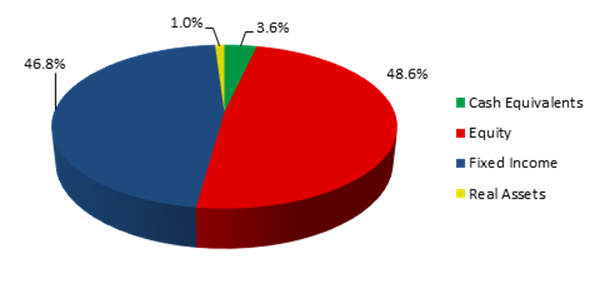

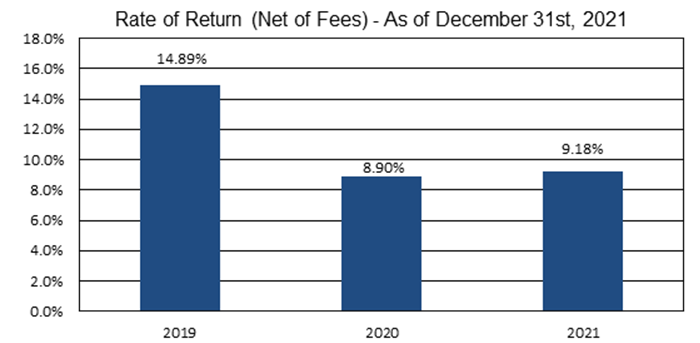

Investment Performance - 2021 Fourth Quarter

TAX STATEMENTS: When to Expect Them

Every year our beneficiaries and donors receive a tax statement from us pertaining to their OSNT sub-account. This year you should look for your tax documents to arrive from Key Private Bank by mid-March.

PLEASE REMEMBER THAT YOU WILL RECEIVE THEM FROM KEY PRIVATE BANK, NOT FROM OUR OFFICE.

- Why Can’t I Get It Quicker?

Each year we are asked why the tax documents are not available sooner. The simple answer is that there are different deadlines for providing this information for Agency/Investment Management Accounts and for Trust Accounts (Schedule K-1). The Internal Revenue Service deadline for Fiduciary Returns is April 15, 2021. A Detailed Tax Information Letter (Schedule K-1) is issued to the beneficiaries of a trust when the Fiduciary Trust Return (Form 1041) is completed.

- What Should I Do With It When I Get It?

When you receive your tax document, if you do not know what to do, you should consult a CPA or tax preparer. Unfortunately, we cannot give you tax advice and cannot tell you whether or not you will need to file taxes.

FULLY VIRTUAL: May 5 & 6, 2022 Annual Convention

After much consideration and discussion about what would be best for our participants, it has been decided that our 2022 State Convention will be held online using Zoom. We’re currently putting together a schedule of dynamic speakers and topics of interest to our community.

Participants in our state convention include people who experience a disability, family members and supporters of people with disabilities, disability professionals, volunteers, and staff and board members from chapters of The Arc across Oregon.

Stay informed and be notified when registration opens by going to https://thearcoregon.org/2022-convention/

Newsletter Delivery

If you would prefer to receive our quarterly newsletter by email, subscribe here.

To request a printed copy mailed to your home or office each quarter, please do one of the following:

- Call our office at (503) 581-2726

- Email us at info@oregonsnt.org

- Update your contact information

Questions & Answers

There were 22 first-party and 9 third-party accounts opened in 2021. As of December 2021, we have a total of 659 funded and 28 unfunded for a total of 687 accounts.

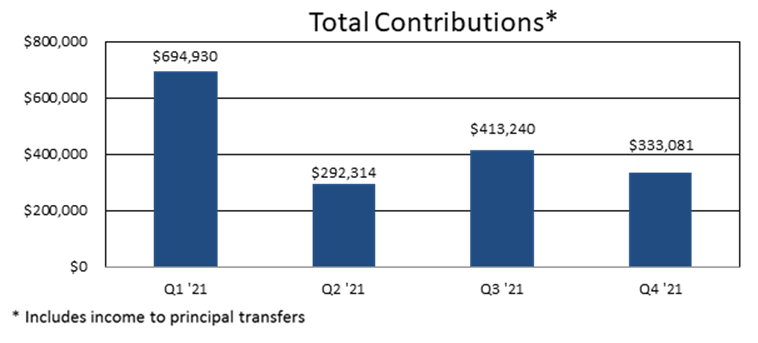

There were 35 deposits for initial funding, 45 into existing 3rd party accounts, and 326 into 1st party accounts totaling $1,737,719.54.

There were 2,304 disbursements issued for sub-account beneficiaries for a total of $1,543,748.17 in 2021.

If you have a question you’d like answered or a topic for us to address in a future newsletter, please email us at info@oregonsnt.org.